Summary Message

Guyana’s economic strength lies in how wisely its finances are managed. Under the

PPP/C administration, for every dollar spent, two dollars are saved in reserves and liquid

assets, a disciplined approach that has held true both before and after oil revenues began

flowing. This means the country is building a financial cushion to weather future storms and

invest in long-term prosperity. In contrast, the APNU+AFC government saved just forty cents for

every dollar spent, leaving Guyana exposed and less prepared for economic shocks.

Think of it like this: if your household spends $100 and saves $200, you’re building wealth. But if

you spend $100 and save only $40, you’re living on the edge.

Key Insights

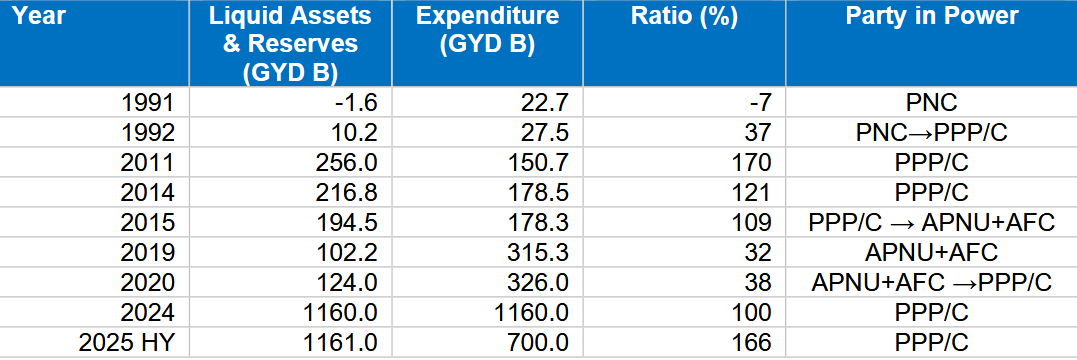

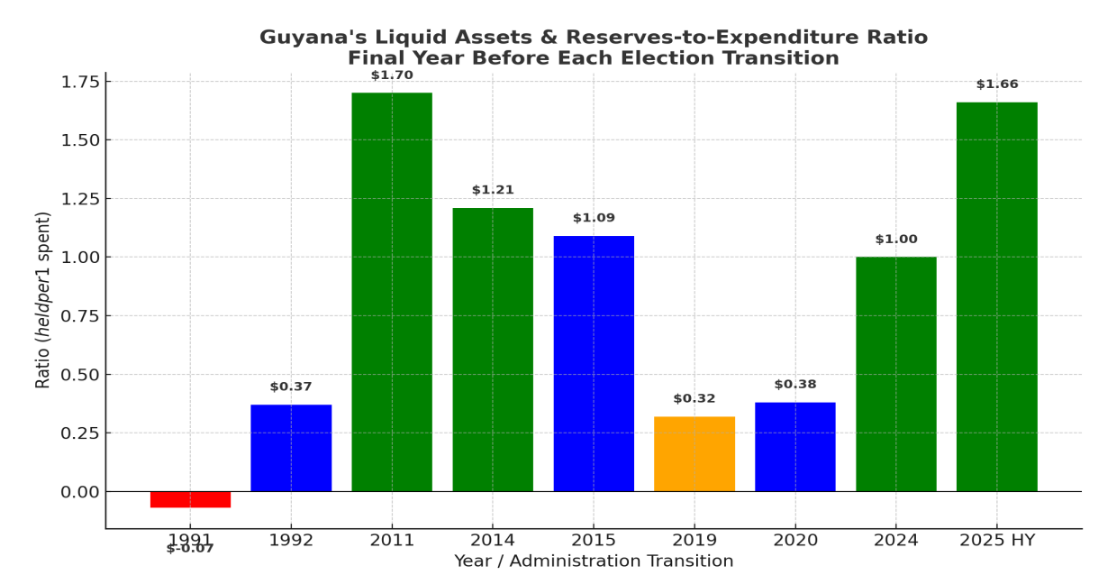

- The Liquid Assets & Reserves-to-Expenditure Ratio measures how much the

government holds in liquid assets and reserves combined (in the banking sector) for

every $1 it spends. - APNU+AFC and other critics love to claim that PPP/C’s fiscal strength comes from oil,

and that they didn’t have the same advantage. This is why this author developed this

metric — to strip away political spin and measure fiscal discipline in both the pre-oil and

oil eras. - The story this metric tells kills the PNC/APNU narrative: PPP/C reached its all-time

record ratio of 170% in 2011 — $256B in liquid assets & reserves over $150.7B

expenditure — nearly a decade before first oil in December 2019. - Under PPP/C, Guyana has often saved more than it spends (approximately two dollars

for every dollar spent); under APNU+AFC, the reverse has been true.

In 2019, APNU+AFC left just $102.2B in liquid assets & reserves against $315.3B in

expenditure — a perilous 32% ratio. - In 2025 HY, PPP/C has restored fiscal strength to near-historic highs — $1.161T in

liquid assets & reserves over $700B in spending — just weeks before the September 1,

2025 election.

The Election-Year Fiscal Scorecard

From Bankruptcy to Record-Breaking Resilience

The PPP/C story is one of transformational fiscal discipline.

In 1992, Guyana was emerging from the PNC’s fiscal ruin — negative $1.6B in reserves in 1991

against $22.7B spending (–7%), turned into $10.2B reserves over $27.5B spending (37%) in

PPP/C’s first year. Over the next two decades in power, the PPP/C steadily built fiscal buffers.

By 2011, under former President, Dr. Bharrat Jagdeo, Guyana had $256B in liquid assets &

reserves against $150.7B in spending a 170% ratio. This was almost a decade before a single

drop of oil was produced, proving that the PPP/C’s fiscal strength was the result of prudent

management, not petroleum resources.

The Collapse Under APNU+AFC

When PPP/C lost power in 2015, they handed APNU+AFC a 109% ratio — $194.5B in liquid

assets & reserves against $178.3B in spending. By 2019, APNU+AFC had squandered that

position, leaving only $102.2B in liquid assets & reserves against $315.3B spending — a 32%

ratio, dangerously low for economic resilience.

The Return to Strength

PPP/C returned to office in August 2020 and immediately began repairing the damage. By 2024,

liquid assets & reserves matched annual expenditure at $1.16T each (100%). In 2025 HY,

reserves & liquid assets stood at $1.161T against $700B spending — a 166% ratio, near the

historic high, just ahead of the September 1, 2025 election.

Why This Matters for the 2025 Election

The PPP/C’s fiscal track record — from rescuing Guyana from bankruptcy in 1992 to reaching

pre-oil record highs in 2011, to restoring near-record levels in 2025 — is unmatched. Conversely,

the APNU+AFC’s record is equally clear: inherited strong buffers in 2015, left behind a near-crisis

position in 2019. Therefore, the choice in September is between discipline that builds resilience

and recklessness that drains it.

Conclusion

The numbers tell a clear and compelling story: The PPP/C governs with fiscal discipline,

consistently building strong financial buffers that anchor Guyana’s economic resilience — buffers

capable of withstanding both external shocks (like global downturns) and internal challenges

(such as political instability or natural disasters).

In contrast, the APNU+AFC has not demonstrated this prudence. Their tenure revealed how

quickly reserves can be depleted when fiscal discipline is absent.

As we look to 2025, one truth stands firm:

Guyana’s resilience is not built on oil alone — it’s built on the PPP/C’s unwavering

commitment to sound financial management.