Key highlights

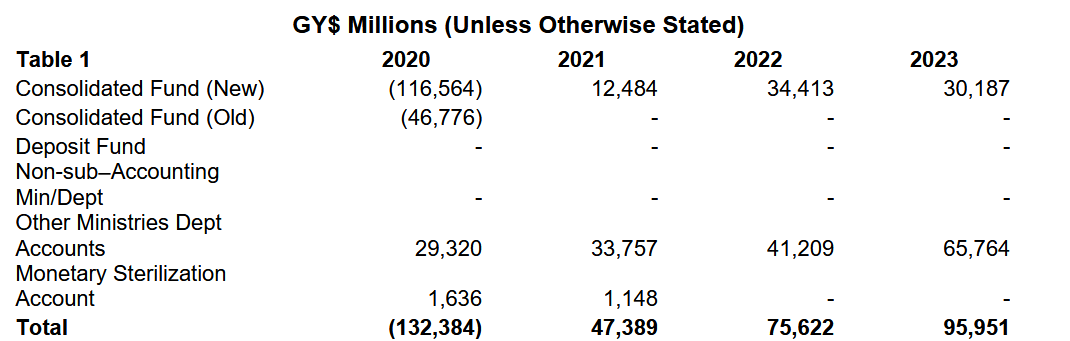

- Contrary to Dr. Goolsarran’s claim that the Consolidated Fund recorded an overdraft balance of $112 billion in 2023; according to the Auditor General’s Report (2023), the Consolidated Fund recorded surplus balances for the years 2021-2023. It is unclear what the source of Dr. Goolsarran’s data was.

- With respect to the accumulated overdraft balances on the Consolidated Fund in the pre- 2020/2021 period, those were remedied appropriately in accordance with the Fiscal Management and Accountability Act, in 2021 by the incumbent government, and which remains in a surplus balance as of the end of 2023.

- In Guyana’s context, the usefulness of GNI vs GDP depends on whether, to what extent, if any, foreign entities, mainly the oil companies, repatriate their profits to their parent companies, or whether those profits are reinvested (partially or fully) in the local economy.

- The 49% debt-to-GNI ratio signals a modest debt sustainability risk, while the debt-to-GDP ratio of 27% signals a very low level of sovereign debt risk. Additionally, Dr. Goolsarran ignored other debt sustainability indicators such as the debt service to revenue ratio (debt coverage ratios), which is below 10% relative to non-oil revenue, and the external debt- to-reserves ratio of 2.03x, a reserve coverage indicating that the country’s total net foreign exchange reserves can repay the total external debt twice.

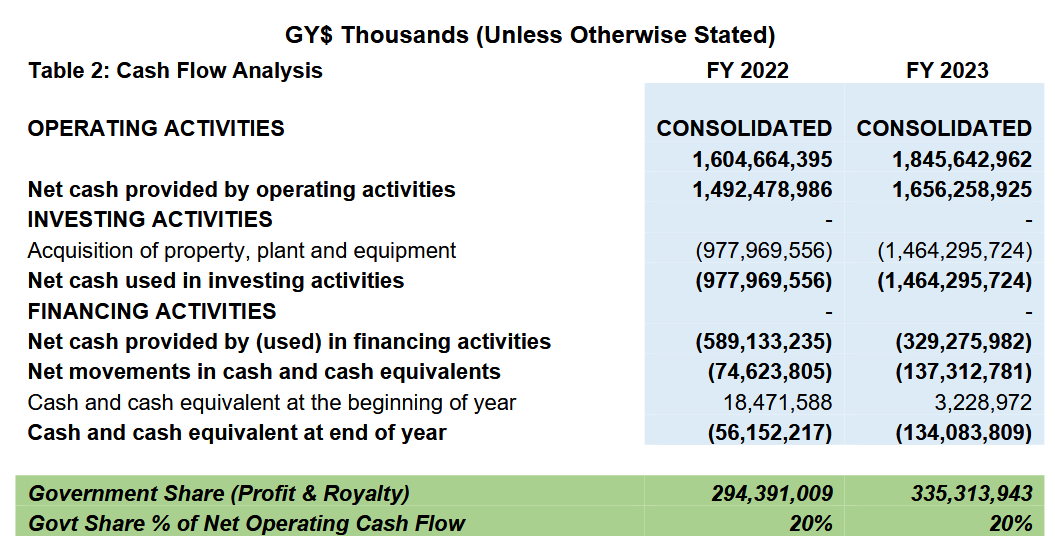

- The cash flow analysis conducted by this author indicates that the Government of Guyana’s total revenue from crude oil production in the form of royalties and profit, amounted to $294.4 billion in 2022, which rose to $335.3 billion in 2023, accounting, in both instances, for 20% of the cash flow provided by operating activities.

- Conversely, in the case of the oil companies: EMGL, Hess and CNOOC, they have been reinvesting 100% of their share of profit together with the recoverable costs for previous projects in the Stabroek block, to finance ongoing exploration as well as development of future projects in the Stabroek block. This simply means that the oil companies have not been repatriating any of their profits to their parent companies for the purpose of paying dividends to their shareholders, as they continue to invest and/or reinvest 100% of their profits in the Guyana market.

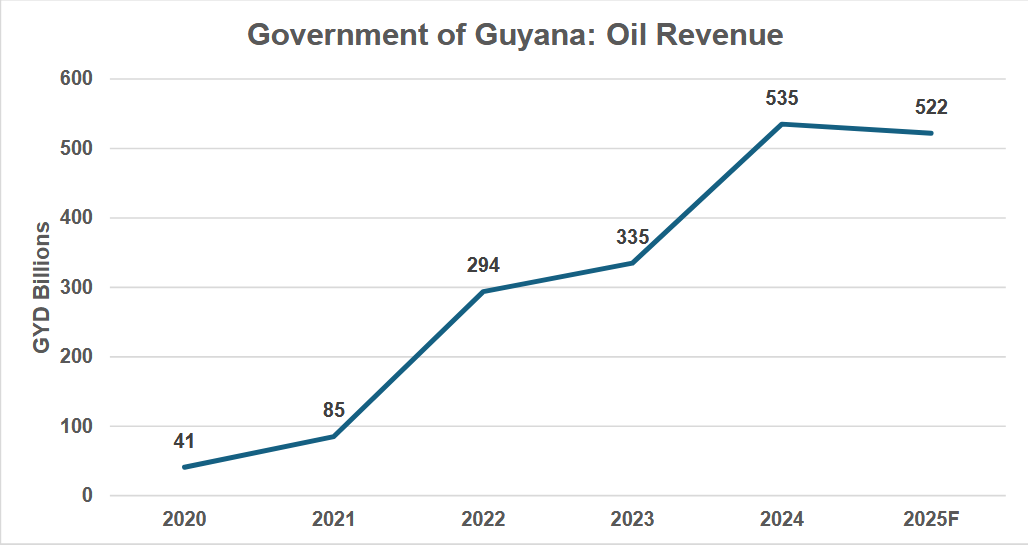

- The result or impact on the Guyana economy: Proven crude oil reserves have grown from 3 billion barrels in 2015 when the first commercial discovery was announced, to over 11 billion barrels of oil equivalent to date. Resultantly, oil revenues flowing to the national treasury has increased nearly thirteen-fold in just five years, from $41 billion since first oil in 2019/2020, to $535 billion in 2024 and an estimated $522 billion in 2025.

Introduction

In his column published in the Stabroek News edition of May 19, 2025, titled “The 2025 IMF Consultation Report”, Dr. Anand Goolsarran, former Auditor General and a long-standing APNU+AFC sympathizer, contends:

“The IMF’s assessment of the public debt as having a low risk of distress must be viewed with some degree of caution. At the end of 2024, the public debt stood at US$5.993.8 billion, compared with US$4,508.8 million at the end of 2023, an increase of US$1,485.0 million, or 32.9 percent. These debts are used to finance the National Budget, especially local borrowings in the form of Treasury Bills and debentures. In fact, the public debt has trebled over the last five years, due primarily to an over five-fold increase in the internal debt through the issuance of debentures valued at $200 billion in 2021 to liquidate the overdraft on the Consolidated Fund. However, at the end of 2023, the overdraft was $112.461 billion due to the continuation of past practices to have deficit budgeting, as opposed to balanced budgeting. Considering the recorded fiscal deficit of $376.409 billion in 2024, the overdraft on the Consolidated Fund would have increased to an estimated

$488.870 billion! This is despite the requirement of the Fiscal Management and Accountability (FMA) Act for all overdrafts to be liquidated by the end of the fiscal year”.

And that:

“According to the IMF, a country’s public debt is considered sustainable if the government is able to meet all its current and future payment obligations without exceptional financial assistance or going into default. An important tool used for this purpose is the debt-to-GDP ratio. At the end of 2024, Guyana’s debt-to-GDP ratio decreased from 27.0 percent to 24.3 percent, despite the significant increase in the public debt. The main reason for this is that as production of crude oil increases, so is the GDP, which is the denominator in the debt-to-GDP ratio. However, the ratio is somewhat misleading in that 87.5 percent of crude oil production does not belong to Guyana. That apart, considering recent trends in the price of crude oil, the Authorities need to be guarded against incurring future debts while at the same time addressing how the public debt can be reduced over the short- to medium-term. This may require accelerating attempts to have a balanced budget”.

This article challenges these two primary contentions put forward by the former Auditor General and opposition aligned sympathizer, that the (i) Consolidated Fund (CF) is projected to have an overdraft balance of some $112 billion in 2023, which would have increased to some $488 billion [in 2024] and (ii) that debt-to-GDP ratio is a misleading debt sustainability indicator to measure the debt capacity and debt service risks of the economy.

Discussion and Analysis

Dr. Goolsarran’s Consolidated Fund Balance of $112 billion inaccurate.

It would appear that Dr. Goolsarran has manufactured the overdraft balance he claimed that the Consolidated Fund reflected in 2023. As shown in table 1, the CF recorded surplus balances for the years 2021-2023. It is unclear what the source of Dr. Goolsarran’s data was.

GDP versus GNI

Gross Domestic Product (GDP) measures the total value of goods and services produced within the economy over a specified period of time regardless of who owns the production, usually a fiscal year. GDP can be calculated with the following equation: GDP = G + C + I + (X-M);

Where:

G = Government spending

C = Private consumption (households’ expenditure) I = Investments (by firms: FDI + Local)

(X-M) = Net exports

On the other hand, Gross National Income (GNI) includes GDP plus net income earned from abroad (such as wages, dividends and profits from foreign investments), while subtracting income paid to foreign entities operating within the country. In other words, the profits earned from foreign entities operating within the country, will be subtracted in the GNI equation, assuming that the profits earned from foreign entities are repatriated to the parent companies abroad.

In Guyana’s context, the usefulness of the GNI metric versus the GDP metric depends on whether, to what extent, if any, foreign entities, mainly the oil companies, repatriate their profits to the parent companies, or whether those profits are reinvested (partially or fully) in the local economy. This is essentially the argument made by Dr. Goolsarran et.al, that the debt-to-GDP ratio is distorted because the oil companies in particular, 87.5 % of the oil produced in Guyana,

the earnings therefrom, does not belong to Guyana, therefore, the debt-to-GNI ratio would be more accurate1.

According to the World Bank’s database, in 2023, Guyana’s GNI was US$10.4 billion, 47% lower than the overall value of GDP in that year, of about US$19 billion. This would give rise to a debt- to-GNI ratio of about 49%, whereas the debt-to-GDP ratio in 2023 was 27%. Albeit, for argument’s sake, the 49% debt-to-GNI ratio signals a modest debt sustainability risk, while the debt-to-GDP ratio of 27% signals a very low level of sovereign debt risk. Additionally, Dr. Goolsarran ignored other debt sustainability indicators such as the debt service to revenue ratio (debt coverage ratios), which is below 10% relative to non-oil revenue, and the external debt-to-reserves ratio of 2.03x, a reserve coverage indicating that the country’s total net foreign exchange reserves can repay the total external debt twice. These are historically solid indicators in terms of debt service and external debt coverage relative to the size of total foreign exchange reserves that was completely ignored from Goolsarran’s analysis.

Notwithstanding the foregoing, it is worthwhile to delve into a more in-depth analysis concerning the merits or demerits of these two indicators: GDP vs GNI within the Guyana context. In so doing, the notion of the “87.5% crude oil that does not belong to Guyana”, though produced in Guyana, must be tested to determine the impact or non-impact, direct or indirect, on GDP and GNI accordingly.

1 For the purpose of this analysis and discussion, the author relied on FY 2023 data, which are the most recently available data for the World Bank’s adjusted GNI value for Guyana and 2023 financial statements for ExxonMobil Guyana (EMGL), Hess and CNOOC.

As demonstrated in table 2, the consolidated cash flow analysis tells a different story with regards to the 87.5% crude oil produced in Guyana by the oil companies (EMGL, Hess and CNOOC). Evidently, Dr. Goolsarran et.al have long held the notional view; void of basic financial analysis, that the 87.5% representing the 75% cost oil recovery coupled with the oil companies’ profit share, are repatriated to their parent companies. This notion, however, is a misconception owing to the lack of, or poor analysis on their part. The cash flow analysis conducted by this author indicates that the Government of Guyana’s (GoG) total revenue from crude oil production in the form of royalties and profit, amounted to $294.4 billion in 2022, which rose to $335.3 billion in 2023, accounting for 20% of the cash flow provided by operating activities.

Conversely, in the case of the oil companies: EMGL, Hess and CNOOC, they have been reinvesting 100% of their share of profit together with the recoverable costs for previous projects in the Stabroek block, to finance ongoing exploration as well as development of future projects in the Stabroek block. This outturn is evidenced by the negative net cash flow balances at the end of year that have been recurring since the inception of oil production in 2019/2020 (negative net cash balances of $54.2 billion in 2022, and $134 billion in 2023). This simply means that the oil companies have not been repatriating any of their profits to their parent companies for the purpose of paying dividend to their shareholders, as they continue to invest and reinvest 100% of their profits in the Guyana market.

How has Guyana benefited from the reinvestment of the oil companies’ profits?

Proven crude oil reserves have grown from 3 billion barrels in 2015 when the first commercial discovery was announced, to over 11 billion barrels of oil equivalent to date.

Resultantly, oil revenues flowing to the national treasury has increased nearly thirteen-fold in just five years, from $41 billion since first oil in 2019/2020, to $535 billion in 2024 and an estimated

$522 billion in 2025.

Conclusion

Against this background, the debt-to-GDP ratio and the GDP metric in general remain the most useful and suitable tool in the Guyanese context for the reasons stated above. Guyana’s debt sustainability indicators remain sound and solid, displaying the country’s macroeconomic resilience. With respect to the accumulated overdraft balances on the Consolidated Fund in the pre-2020 period, those were remedied appropriately in accordance with the Fiscal Management and Accountability Act, in 2021 by the incumbent government, and which remains in a surplus balance as of the end of 2023.