Summary

The supplementary appropriation Bills presented to the National AssemblyonJuly31,2024,bythesubjectMinisterseekingapprovalof some $40 billion, are in compliance with the Fiscal Management and Accountability Act (2003). It should be noted, too, that the lawful procedures thereof have also been properly adhered to in consonance with the aforementioned Act.This is in stark contrast to the incumbent’s predecessors who, during the period 2015-2020, deliberately violated theFMAAinrespectofsupplementaryexpenditurestotalingawhopping

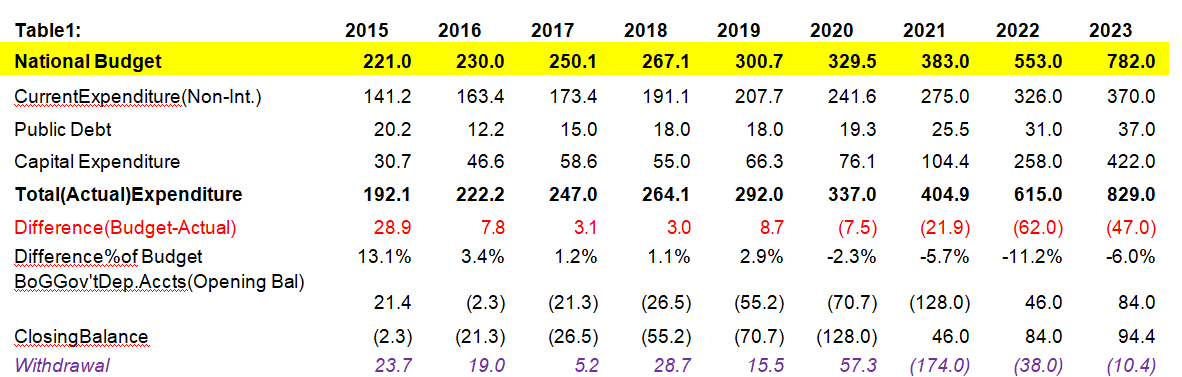

$149billion,thatwerenotsubjectedtoparliamentaryapprovalandscrutiny. Itisworthwhiletonote,aswell,thatundertheincumbentAdministration, the government’s deposit accounts held at the Bank of Guyana have since reverted to their historically surplus balances, as opposed to the illegally rackedupoverdraftbalancesbytheirpredecessors.Asshownintable1,the depositaccountsclosed2021withasurplusbalanceof$46billion,which rose to $94.4 billion (105%) at the end of 2023.

Introduction

The Leader of the Opposition (LO) and at least one other critical commentator of the Government, expressed concerns about the Government’s request for supplementary fundingthroughtheNationalAssembly.Mainly,theLOcontendsthatin2023forinstance, “the Government came to the National Assembly five times for extra money totally $116 billion, nearly 15% more than its initial budgeted sum. The LO surmised that “the more the PPP/C Government spends, the more money is lost through poor planning, mismanagement, and corruption”.

This article seeks to address this issue in terms of the legitimacy of “supplementary appropriation”, in contrast to the former, APNU+AFC Government’s approach to supplementary spending.In the case, the former Government, during their tenure in 2015-2020,departedfromthelegalprovisionspursuanttothecountry’sprincipalfinancial law—that is, the Fiscal Management and Accountability Act (2003) (hereinafter the “FMAA”), as demonstrated hereunder.

DiscussionandAnalysis

First and foremost, considering that the national budget is presented at the beginning of the fiscal year, the need for supplementary funding throughout the fiscal year, as the programmes in the budget are implemented, is not an unusual practice whether it is in public finance, corporate finance, or personal finance. There will always be plausible variances in budgeted costs versus actual costs, especially in relation to capital budgeting.Thesevarianceswouldariseduetoanumberofunavoidablefactors,suchas inflation, supply chain disruptions, exogenous and endogenous factors, unforeseen events etc.

Thus, it does not necessarily mean that there is poor planning on the part of the Government. It is with this basic principle in mind that the drafters of the FMAA had ensured that a number of provisions were embedded within the FMAA, thereby adequatelyprovidingfortheseeventualities.Itthereforefollowsthatthemostimportant concern from the tax-payers vantage point, is whether the supplementary appropriation (s) being sought is/are in conformity with the FMAA.

To this end, Section 22 (1) of the FMAA establishes the “Authority to vary annual appropriations”,whereSection22(1)(c)establishesthat“theamountofanappropriation foranyprogrammemaynotbevariedunderthissectionbymorethantenpercentofthe total amount appropriated for that programme in the applicable appropriation Act.”

Notwithstanding Section 22 (1) (c) of the FMAA as noted above, Section 24 (1) establishesthat“anyvariationofanappropriation,otherthanthose variationsreferredto in Section 22, shall be authorized by a supplementary appropriation Act prior to the incurring of the expenditure thereunder.” This means that if the Minister requires any variation of an appropriation exceeding the 10% threshold pursuant to Section 22 (1) (c) oftheFMAA,thensuchapprovaloughttobesoughtpriortotheexpenditurethereunder, in accordance with Section 24 (1) of the FMAA.

Furthertonote,Section24(5)oftheFMAAstatesthat“theMinistershallnot,inanyfiscal year, introduce more than five supplementary appropriation Bills under this section, except in circumstancesof grave nationalemergency, wherethe Ministermayintroduce a Bill, intituled an emergency appropriation Bill, to meet the situation.” Additionally, Section 23 (1) of the FMAA establishes that “the Minister shall present to the National AssemblyanyappropriationamendmentBillreferredtoinsubsection22(2)nolaterthan the end of the eleventh month of the current fiscal year.

The sum in question being sought through Financial Papers Numbers 1 and 2 in the NationalAssemblybytheSeniorMinisterwithresponsibilityforFinance,amountsto just over $40 billion, representing 3.5% of the $1.146 trillion budget 2024 that was approved earlier in the year.

Conversely,thesamecannotbeattributedtotheincumbent’spredecessorsasillustrated inthetable(1)above.Duringtheperiod2015-2019period,theformerMinisterofFinance presented a total of eight (8) supplementary appropriation Bills, all of which were approved by the house. On the face of it, this gives the impression that the former government did a great job in terms of managing the national budget in a way that minimizes the need for too many supplementary funding. Be that as it may, an in-depth analysis into this matter has overwhelmingly disproven this notion.

In existence, there is compelling and otherwise, indisputable evidence suggesting that the former Minister of Finance deliberately violated the FMAA, by circumventing the legally established procedures for the approval of supplementary spending through the NationalAssembly.Indoingso,theformerFinanceMinistereffectivelyengineeredafalse perceptionthathewaspracticingtightbudgetarycontrols.Unfortunately,thiswasnotthe case by any measure of one’s imagination.

Towards that end, during the period 2015-2020, the former government unlawfully withdrew from the government’s deposit accounts held at the Bank of Guyana, a cumulative sum totally $149.4 billion in contravention of the FMAA. In this respect, Section60(1)oftheFMAActstatesthat…”theMinistermayapprovetheuseofadvances in the form of an overdraft on an official bank account to meet cash shortfalls during the execution of the annual budget”.

In other words, the FMAA provides for the deposit accounts to be overdrawn. However, Section (2) of the FMAA Act states that…” the Minister shall repay in full alladvances in the form of an overdraft on an official bank account on or before the end of the fiscal year during which that overdraft was drawn”. Yet, the overdraft balances referenced herein, were never cleared for the entire five years period (2015-2020) by the former Minister of Finance; not until the incumbent Government, in May 2021,made the necessary provisions to regularize those overdrafts in conformance with the FMAA.

ItisworthwhiletonotethatundertheincumbentAdministration,thegovernment’sdeposit accounts held at the Bank of Guyana have since reverted to their historically surplus balances,asopposedtotheillegallyrackedupoverdraftbalancesbytheirpredecessors. As shown in table 1 above, the deposit accounts closed 2021 with a surplus balance of

$46billion,whichroseto$94.4billion(105%)attheendof2023.

Conclusion

Most evidently and importantly, the supplementary appropriation Bills presented to the National Assembly on July 31, 2024, by the subject Minister seeking approval of some

$40billion,areincompliancewiththeFiscalManagementandAccountabilityAct (2003). It should be noted, too, that the lawful procedures thereof have also been properly adhered to in consonance with the FMAA.This is in stark contrast to the incumbent’s predecessors who, during the period 2015-2020, deliberately violated the FMAA in respect of supplementary expenditures totaling a whopping $149 billion, that were not subjected to parliamentary approval and scrutiny.